Disconnected Data. Missed Signals. Slower Growth.

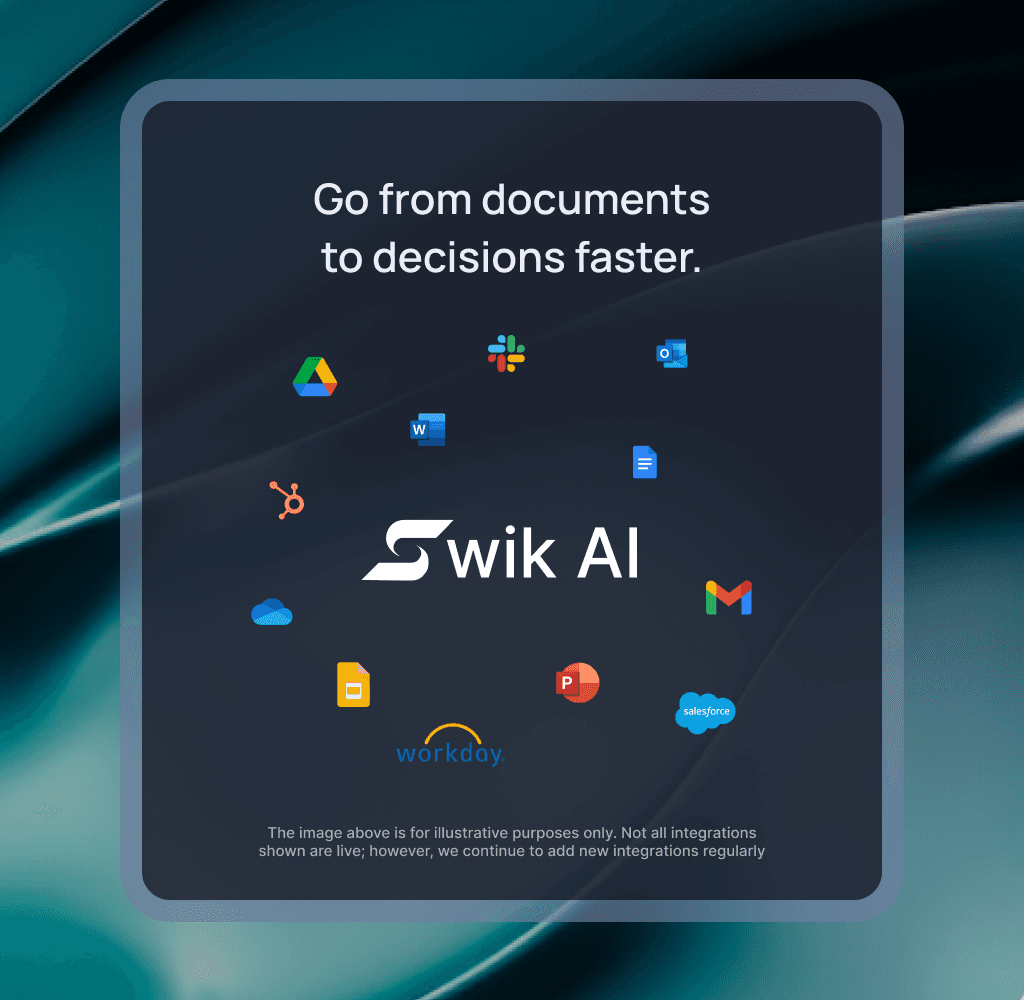

Small business lenders are drowning in disconnected data - Email, CRM, LOS, SharePoint, Dropbox, Box, and other databases that don’t talk to each other. Relationship managers chase files, underwriters rebuild the same analysis, and borrowers wait while opportunities slip away.

Deals slow down. Relationships weaken. Growth stalls.

30–50% RM time lost to admin and data hunting

5–10 extra days per loan from document and system gaps

$10M+ in missed opportunity per regional bank each year

Swik AI connects every corner of your data environment - Email, CRM, LOS, SharePoint, Dropbox, Box, other databases, and turns disconnected activity into clear, actionable insight.

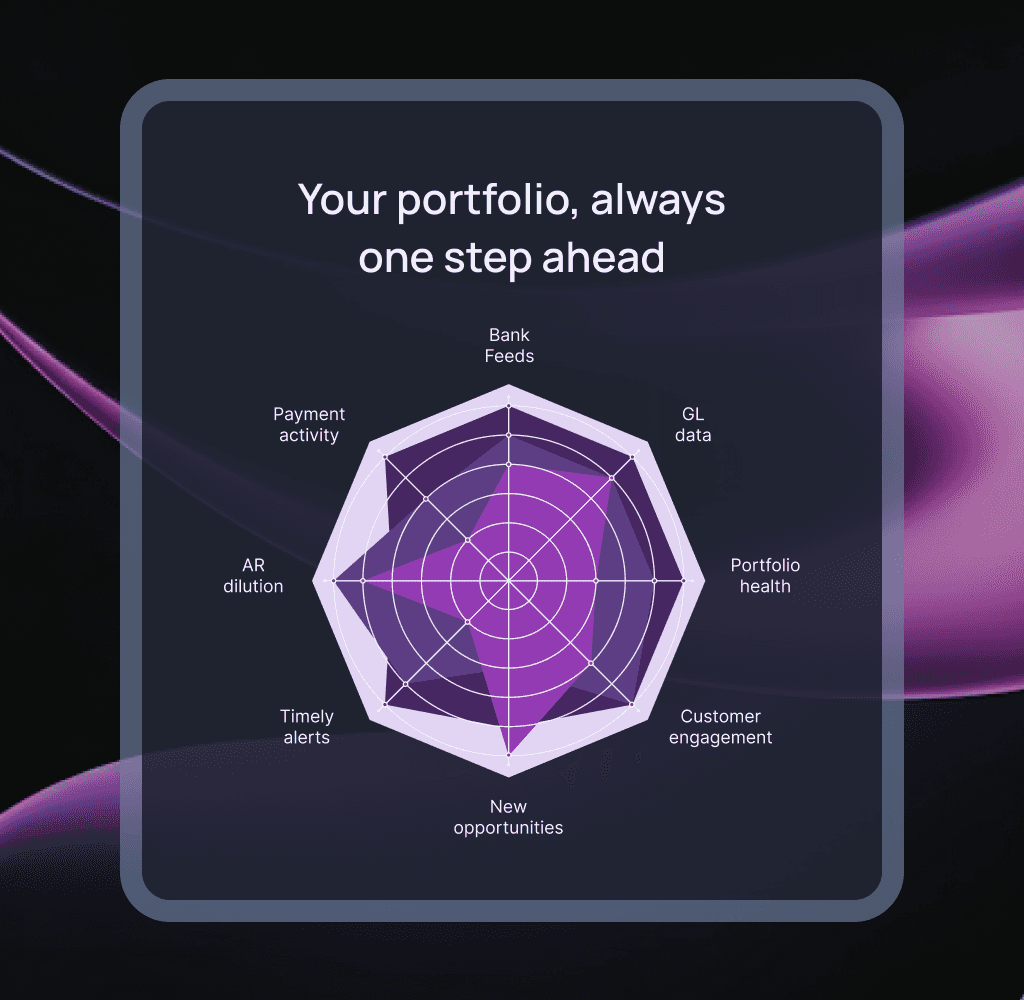

It helps lenders find the right businesses, close loans faster, and stay ahead of portfolio risk - all on top of the systems you already use.

Swik AI connects every corner of your data environment and turns scattered information into actionable intelligence, helping your team find the right businesses, build stronger relationships, and manage portfolios with confidence.

How Swik AI Works

Teams using Swik AI have seen:

Faster growth, stronger relationships, lower portfolio risk - without replacing a single system.

Built for Bank-Grade Trust

Swik AI is designed for the most regulated environments.

Read-only by default: Data never leaves your systems.

Governed write-backs: Explicit, role-based, and fully auditable.

Private deployments: Cloud or on-prem, BYO encryption keys.

Enterprise controls: SSO/SAML/SCIM, RBAC, SOC2 readiness, immutable logs.

Swik AI is the intelligence layer for small business lending.

It connects every system across a financial institution, from CRM and LOS to email and file sharing softwares, to give lenders a unified, actionable view of their customers. By transforming scattered data into clear insights, Swik helps banks and credit unions find the right businesses, close loans faster, and manage portfolios proactively, all without replacing existing systems.